Free Promissory Note Template for Personal Loan to Family Member

Navigating Loans to Loved Ones: A Free Promissory Note Template

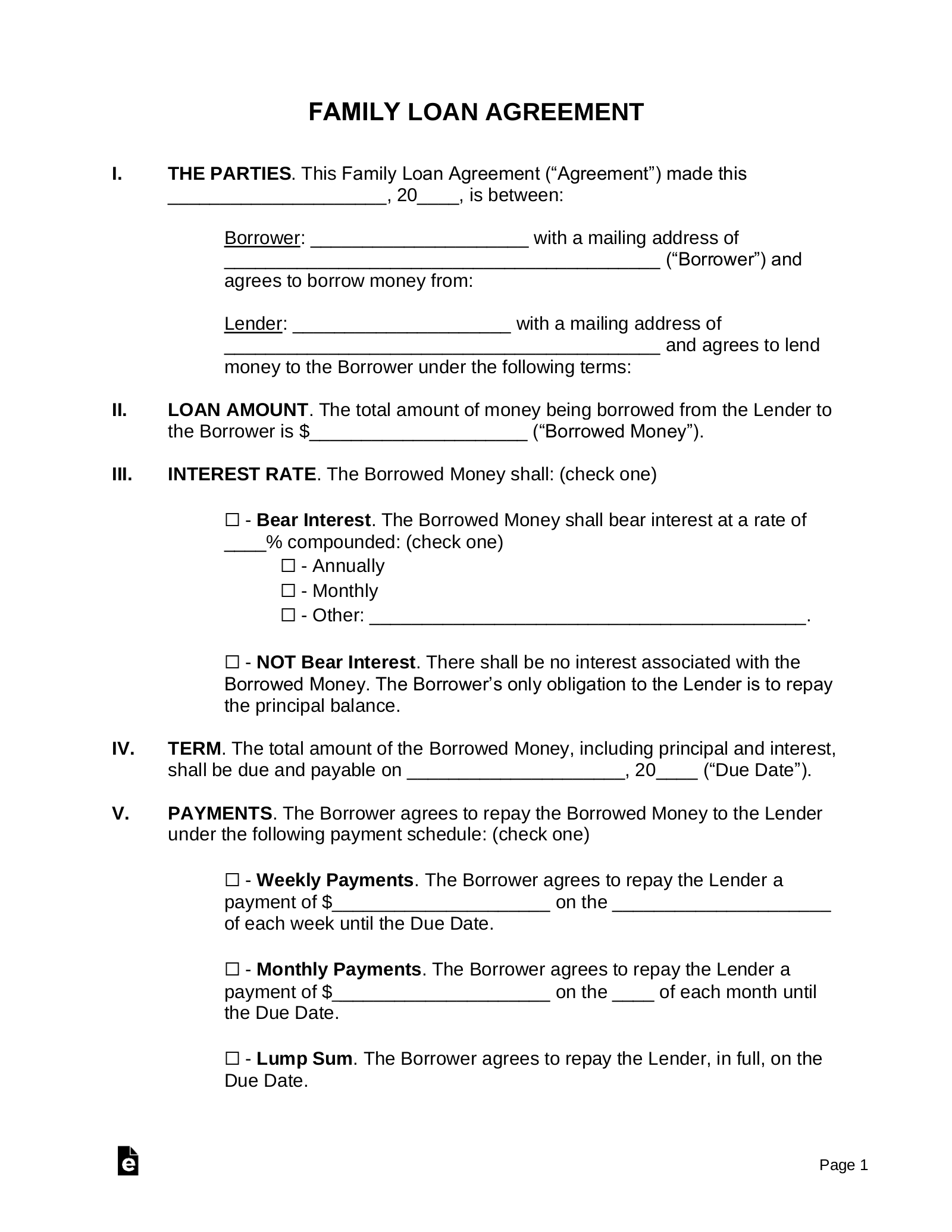

Lending money to family members can be a delicate situation. While the intention is often to help, it can quickly strain relationships if not handled correctly. One of the best ways to protect both the lender and the borrower is to formalize the agreement with a promissory note. This legally binding document outlines the terms of the loan, ensuring everyone is on the same page and minimizing potential misunderstandings down the line. A

free promissory note template

can be an invaluable resource in such scenarios.Why Use a Promissory Note for Family Loans?

The primary benefit of using a promissory note, even when dealing with family, is clarity. It clearly defines:

*

The Loan Amount:

The exact amount of money being lent. *Interest Rate (If Applicable):

Whether interest will be charged, and if so, at what rate. *Repayment Schedule:

How often payments will be made (e.g., monthly, quarterly), the amount of each payment, and the due date. *Maturity Date:

The date by which the entire loan must be repaid. *Default Terms:

What happens if the borrower fails to make payments as agreed. *Security (If Any):

Is the loan secured by collateral (e.g., a car, property)?Without a written agreement, memories can fade, interpretations can differ, and resentment can build. A promissory note provides a concrete record of the loan terms, reducing the likelihood of disputes. Think of it as relationship insurance!

Key Elements of a Promissory Note Template

A good promissory note template should include the following essential sections:

1.

Parties Involved:

Clearly identify the lender (the person lending the money) and the borrower (the person receiving the money), including their full legal names and addresses.2.

Principal Amount:

State the exact amount of money being borrowed. This should be written out in both numerical and written form (e.g., $5,000.00 - Five Thousand Dollars).3.

Interest Rate:

If you're charging interest, specify the annual interest rate (APR). Remember to research prevailing interest rates to ensure your rate is fair and doesn't raise eyebrows with tax authorities. Charging no interest may have tax implications as well, so consider consulting a tax professional.4.

Repayment Terms:

This is where you detail the repayment schedule. Will payments be made monthly, quarterly, or annually? How much will each payment be? What is the exact date each payment is due? Be specific! Consider including a grace period for late payments.5.

Late Payment Penalties:

Outline any penalties for late payments. This could be a flat fee or an additional percentage of the overdue amount. While you might hesitate to impose penalties on family, including them can encourage timely payments.6.

Default:

Define what constitutes a default. This typically includes missing payments for a certain period. Specify what actions the lender can take in the event of a default, such as demanding immediate repayment of the entire loan balance.7.

Governing Law:

Specify the state law that will govern the promissory note.8.

Signatures:

Both the lender and the borrower must sign and date the promissory note. Having the signatures notarized adds an extra layer of legal validity.Finding a Free Promissory Note Template

Many websites offer free promissory note templates. A simple online search for "free promissory note template" will yield numerous options. However, it's crucial to choose a template from a reputable source. Look for templates that are:

*

Comprehensive:

They cover all the essential elements mentioned above. *Customizable:

They allow you to easily fill in the blanks with your specific loan details. *Legally Sound:

While free templates can be a great starting point, consider having an attorney review the final document, especially for larger loan amounts, to ensure it complies with your local laws.Considerations When Lending to Family

Beyond the legal aspects, remember the emotional considerations of lending to family. Be realistic about the borrower's ability to repay the loan. Are they financially stable? Do they have a history of managing money responsibly? Also, be prepared for the possibility that the loan may not be repaid. Decide beforehand how you will handle this situation without damaging the relationship. Open communication is key. Discuss expectations, concerns, and potential challenges upfront.

Using a Free Promissory Note Template for Personal Loan to Family Member can help protect both parties and foster a healthy relationship, even when money is involved. Remember to tailor the template to your specific needs and consult with legal and financial professionals when necessary. Taking these steps can ensure a smoother and less stressful lending experience.

Comments

Post a Comment