How to Find Student Loan Balance

How to Find Your Student Loan Balance: A Comprehensive Guide

Navigating the world of student loans can feel overwhelming. Between different loan types, interest rates, and repayment plans, keeping track of your overall balance can sometimes feel like a Herculean task. However, knowing your student loan balance is crucial for effective financial planning, budgeting, and making informed decisions about repayment strategies. This guide will provide you with a step-by-step approach to finding your student loan balance, empowering you to take control of your debt.

Why Knowing Your Student Loan Balance Matters

Before diving into the "how," let's briefly explore the "why." Understanding your student loan balance allows you to:

*

Create a Realistic Budget:

Knowing how much you owe is fundamental to budgeting effectively. It allows you to allocate funds specifically for loan repayment and avoid surprises. *Choose the Right Repayment Plan:

Many repayment options are available, including income-driven repayment plans. Knowing your balance, interest rate, and income will help you determine the best plan for your circumstances. *Plan for Future Financial Goals:

Student loans can significantly impact your ability to achieve other financial goals, such as buying a home, starting a family, or investing. A clear understanding of your debt will help you plan for these milestones. *Avoid Default:

Tracking your balance and making timely payments is essential to avoid defaulting on your student loans, which can have severe consequences for your credit score and financial future. *Explore Refinancing or Consolidation:

If you have multiple loans, refinancing or consolidating them might be an option to simplify your payments or potentially lower your interest rate. Knowing your balances is the first step.Methods for Finding Your Student Loan Balance

Here are several reliable methods for finding your student loan balance:

1. Federal Student Aid Website (StudentAid.gov)

This is often the most straightforward and comprehensive option for federal student loans. The Federal Student Aid website, managed by the U.S. Department of Education, provides a centralized portal for managing your federal student loans.

*

How to Access:

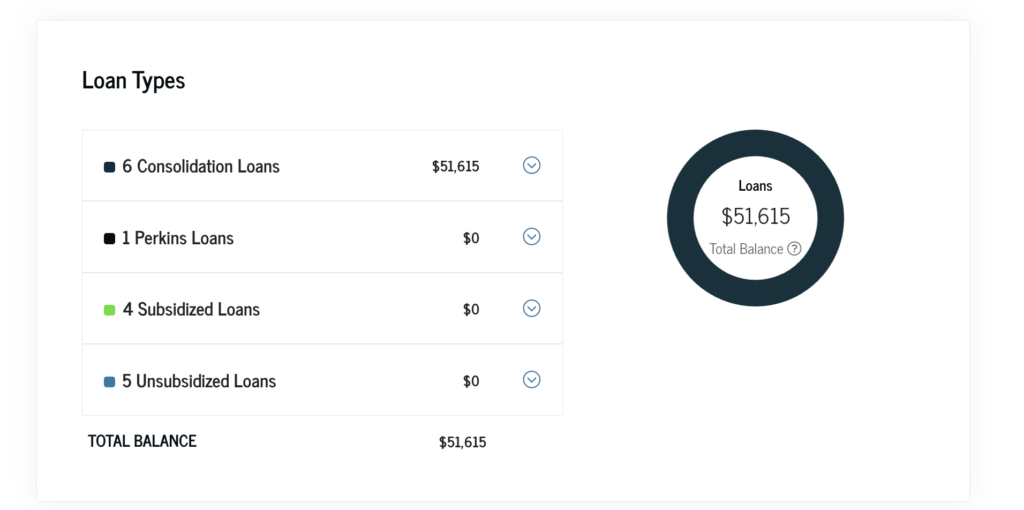

Go to StudentAid.gov and log in using your FSA ID (username and password). If you don't have an FSA ID, you can create one on the website. *What You'll Find:

Once logged in, you can view a detailed breakdown of all your federal student loans, including: * Loan servicer information (who you make payments to) * Outstanding loan balance for each loan * Interest rates * Loan status (e.g., in repayment, deferment, forbearance)2. Loan Servicer Websites

Your loan servicer is the company that handles the billing and other services for your student loans. You can typically find your loan balance by logging into your servicer's website. If you're unsure who your servicer is, the Federal Student Aid website (mentioned above) will provide this information.

*

How to Access:

Visit your loan servicer's website and log in using your username and password. If you've forgotten your login information, you can usually reset it through the website. *What You'll Find:

Similar to the Federal Student Aid website, your servicer's website will display your loan balance, interest rate, loan status, and payment history.3. Credit Reports

While not always the most up-to-date source, your credit report can provide a snapshot of your student loan balance. Keep in mind that credit reports may not reflect the most recent payments or changes in your loan status.

*

How to Access:

You are entitled to a free credit report from each of the three major credit bureaus (Equifax, Experian, and TransUnion) once per year through AnnualCreditReport.com. *What You'll Find:

Your credit report will list your student loan accounts, including the original loan amount, current balance, and payment history.4. Loan Statements

Your loan servicer should send you regular loan statements, either electronically or by mail. These statements typically include your current loan balance, interest rate, payment due date, and other important information. Reviewing your statements regularly is a good habit.

5. National Student Loan Data System (NSLDS)

The NSLDS is a database maintained by the U.S. Department of Education that contains information on federal student loans and grants. You can access your NSLDS record using your FSA ID.

*

How to Access:

Log in to the Federal Student Aid website (StudentAid.gov) using your FSA ID. The NSLDS information is usually accessible from your dashboard. *What You'll Find:

The NSLDS provides a comprehensive view of your federal student loans, including loan balances, loan types, and servicer information.Important Considerations

*

Private Student Loans:

The methods described above primarily apply to federal student loans. For private student loans, you'll need to contact your private loan servicer directly to obtain your loan balance. *Keep Records:

Maintain organized records of your loan documents, statements, and correspondence with your loan servicer. *Regularly Check:

Make it a habit to check your loan balances periodically, especially if you're considering making changes to your repayment plan or exploring refinancing options. *Seek Professional Advice:

If you're struggling to manage your student loan debt or have questions about repayment options, consider seeking advice from a qualified financial advisor or student loan counselor. How to Find Student Loan Balance is a great resource with further in-depth analysis.By using these methods and staying informed, you can effectively track your student loan balance and make informed decisions about your financial future. Taking control of your student loan debt starts with knowing exactly how much you owe.

Comments

Post a Comment