How Much Is The Student Loan Debt_

The Crushing Weight of Higher Education: Understanding the Student Loan Debt Crisis

The pursuit of higher education has long been considered a pathway to a brighter future, a cornerstone of upward mobility. However, for millions of Americans, that path is paved with significant financial burden – the ever-growing weight of student loan debt. The question on many minds is: How Much Is The Student Loan Debt_ , really? The answer, unfortunately, is staggering. Understanding the scope of this crisis is crucial for prospective students, current borrowers, and policymakers alike.

A Look at the Numbers: A National Crisis

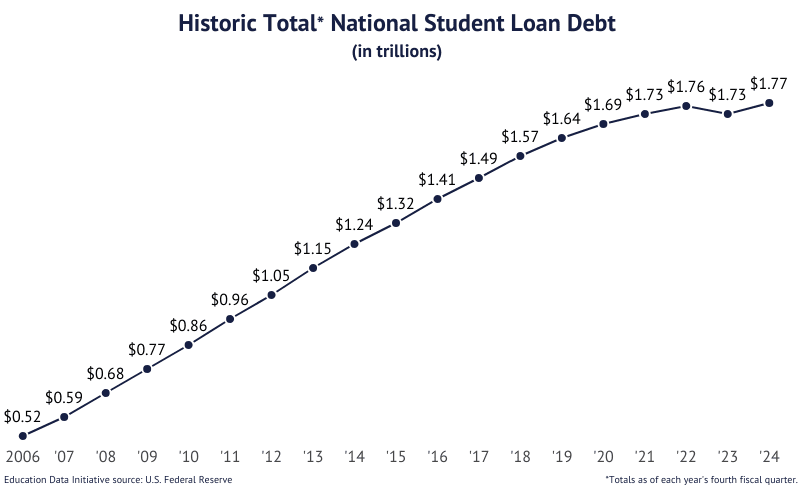

The sheer magnitude of student loan debt in the United States is a cause for serious concern. Collectively, Americans owe over $1.7 trillion in student loan debt. This debt is distributed across more than 45 million borrowers, representing a significant portion of the adult population. To put it in perspective, that's more than the total amount of credit card debt in the nation.

The average student loan debt per borrower is also a significant figure, often exceeding $30,000. This average can vary widely depending on the type of degree pursued, the institution attended, and the amount of financial aid received. Graduate students, particularly those pursuing professional degrees like law or medicine, often face significantly higher debt burdens.

Factors Contributing to the Debt Crisis

Several factors contribute to the escalating student loan debt crisis. One of the primary drivers is the rising cost of tuition. Over the past few decades, tuition fees at both public and private universities have increased at a rate far exceeding inflation. This makes higher education increasingly inaccessible without taking on substantial loans.

Another contributing factor is the increasing number of students pursuing higher education. As the job market becomes more competitive, a college degree is often seen as a necessity for securing stable employment. This increased demand, coupled with rising tuition costs, fuels the growth of student loan debt.

Furthermore, the availability of federal student loans, while intended to make education more accessible, can also contribute to the problem. Students may borrow more than they can realistically afford to repay, especially if they lack a clear understanding of the long-term financial implications.

The Impact of Student Loan Debt

The burden of student loan debt can have a profound impact on borrowers' lives. It can delay or prevent major life milestones such as buying a home, starting a family, or saving for retirement. It can also limit career choices, as graduates may feel pressured to take higher-paying jobs in order to repay their loans, even if those jobs are not aligned with their passions or long-term goals.

Student loan debt can also contribute to financial stress and mental health issues. The constant pressure of repayment can be overwhelming, leading to anxiety, depression, and other mental health challenges.

Addressing the Student Loan Debt Crisis

Addressing the student loan debt crisis requires a multi-faceted approach. Some potential solutions include:

*

Controlling Tuition Costs:

Implementing policies to limit tuition increases at public universities and encouraging private institutions to adopt more affordable pricing models. *Increasing Financial Aid:

Expanding access to grants and scholarships to reduce the reliance on loans. *Improving Financial Literacy:

Providing students with better financial education so that they can make informed decisions about borrowing and repayment. *Debt Relief Programs:

Exploring options for student loan forgiveness or income-driven repayment plans to provide relief to borrowers struggling with their debt.The Future of Higher Education and Debt

The student loan debt crisis is a complex issue with no easy solutions. However, by understanding the scope of the problem, the contributing factors, and the potential consequences, we can begin to develop strategies to mitigate its impact. Investing in education is crucial for individual and societal progress, but it must be done in a way that is both accessible and sustainable. The conversation about How Much Is The Student Loan Debt_ and its impact needs to continue to drive meaningful change to ensure a brighter financial future for all students.

Conclusion:

The student loan debt crisis is a serious problem that demands attention. By raising awareness, advocating for policy changes, and empowering students with financial knowledge, we can work towards a future where higher education is a pathway to opportunity, not a burden of debt.

Comments

Post a Comment