Joe Biden_s Plan to Address Student Loan Debt

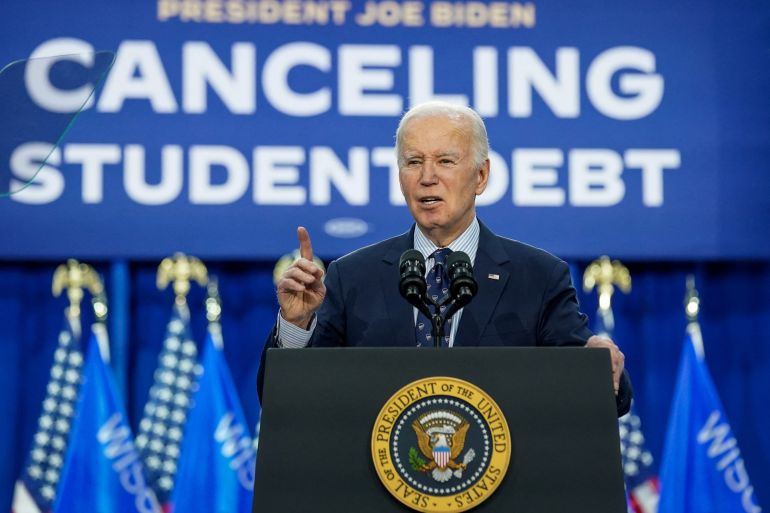

Joe Biden's Plan to Address Student Loan Debt: A Comprehensive Overview

Student loan debt has become a significant burden for millions of Americans, impacting their financial well-being and hindering economic growth. President Joe Biden has made addressing this issue a central part of his economic agenda. His administration has implemented several initiatives aimed at providing relief to borrowers and reforming the student loan system. Joe Biden_s Plan to Address Student Loan Debt offers a multi-pronged approach encompassing debt forgiveness, income-driven repayment plan adjustments, and efforts to hold colleges accountable. Let's delve into the key components of his strategy.

Debt Forgiveness Initiatives:

One of the most talked-about aspects of Biden's plan has been the proposed debt forgiveness program. Initially, the administration announced a plan to cancel up to $10,000 in federal student loan debt for borrowers earning less than $125,000 per year, and up to $20,000 for Pell Grant recipients. This initiative aimed to provide immediate relief to a large segment of the borrowing population. However, this plan faced legal challenges and ultimately was struck down by the Supreme Court.

Despite this setback, the Biden administration remains committed to providing debt relief. They are exploring alternative legal pathways to achieve debt forgiveness and are focusing on other avenues to alleviate the burden on borrowers.

Income-Driven Repayment (IDR) Plan Reform: The SAVE Plan

A cornerstone of Biden's strategy is the overhaul of Income-Driven Repayment (IDR) plans. These plans allow borrowers to make monthly payments based on their income and family size, with any remaining balance forgiven after a certain period. The administration has introduced the Saving on a Valuable Education (SAVE) plan, a new IDR plan designed to be more affordable and accessible.

The SAVE plan offers several significant advantages over previous IDR options:

*

Lower Monthly Payments:

It reduces monthly payments for undergraduate loans to 5% of discretionary income. *Increased Income Protection:

It raises the amount of income that is protected from repayment, meaning borrowers have more money left over for other essential expenses. *Faster Forgiveness:

Borrowers with original loan balances of $12,000 or less will receive forgiveness after 10 years of payments. *No Accrued Interest:

If a borrower makes their monthly payment, their loan balance will not grow due to unpaid interest.The SAVE plan is a significant improvement over previous IDR plans and is expected to provide substantial relief to millions of borrowers, particularly those with low incomes.

Addressing the Root Causes of Student Debt:

Beyond debt forgiveness and IDR reform, Biden's plan also aims to address the underlying causes of student debt. This includes:

*

Holding Colleges Accountable:

The administration is working to hold colleges accountable for leaving students with unaffordable debt. This involves strengthening oversight of colleges and universities, particularly those with high dropout rates and low job placement rates. *Increasing College Affordability:

Biden has proposed increasing investments in Pell Grants and other financial aid programs to make college more affordable for low- and middle-income students. *Simplifying the Financial Aid Process:

The administration is working to simplify the Free Application for Federal Student Aid (FAFSA) to make it easier for students to access financial aid.Impact and Challenges:

Biden's plan to address student loan debt has the potential to significantly improve the financial lives of millions of Americans. It could free up borrowers to invest in their futures, start families, and contribute to the economy.

However, the plan also faces challenges. Legal challenges, as seen with the initial debt forgiveness proposal, remain a significant hurdle. Furthermore, the long-term effectiveness of the plan will depend on its implementation and the ability to address the root causes of rising college costs. There are also debates surrounding the fairness and economic implications of widespread debt forgiveness.

Conclusion:

President Biden's plan to address student loan debt is a comprehensive effort to provide relief to borrowers, reform the student loan system, and address the underlying causes of rising college costs. While the path forward may be complex and face obstacles, the administration's commitment to tackling this issue is clear. The success of these initiatives will have a profound impact on the financial well-being of millions of Americans and the overall health of the economy. As the plan continues to evolve, staying informed about the latest developments and understanding the available options is crucial for borrowers navigating the complexities of student loan repayment.

Comments

Post a Comment