new Student Loan Tax Bill

The Looming Changes: Understanding the New Student Loan Tax Bill

Navigating the complex world of student loans can feel like a never-ending task. From understanding interest rates to deciphering repayment plans, borrowers often face a confusing landscape. Recently, a new Student Loan Tax Bill has been proposed, sparking both hope and concern among current and prospective students. This article aims to break down the key components of this bill, analyze its potential impact, and provide insights into what it means for borrowers across the country.

Key Provisions of the New Bill

While the specifics can vary depending on the final version passed into law, student loan tax bills generally focus on alleviating the tax burden associated with student loan repayment. Some common areas of focus include:

*

Student Loan Interest Deduction:

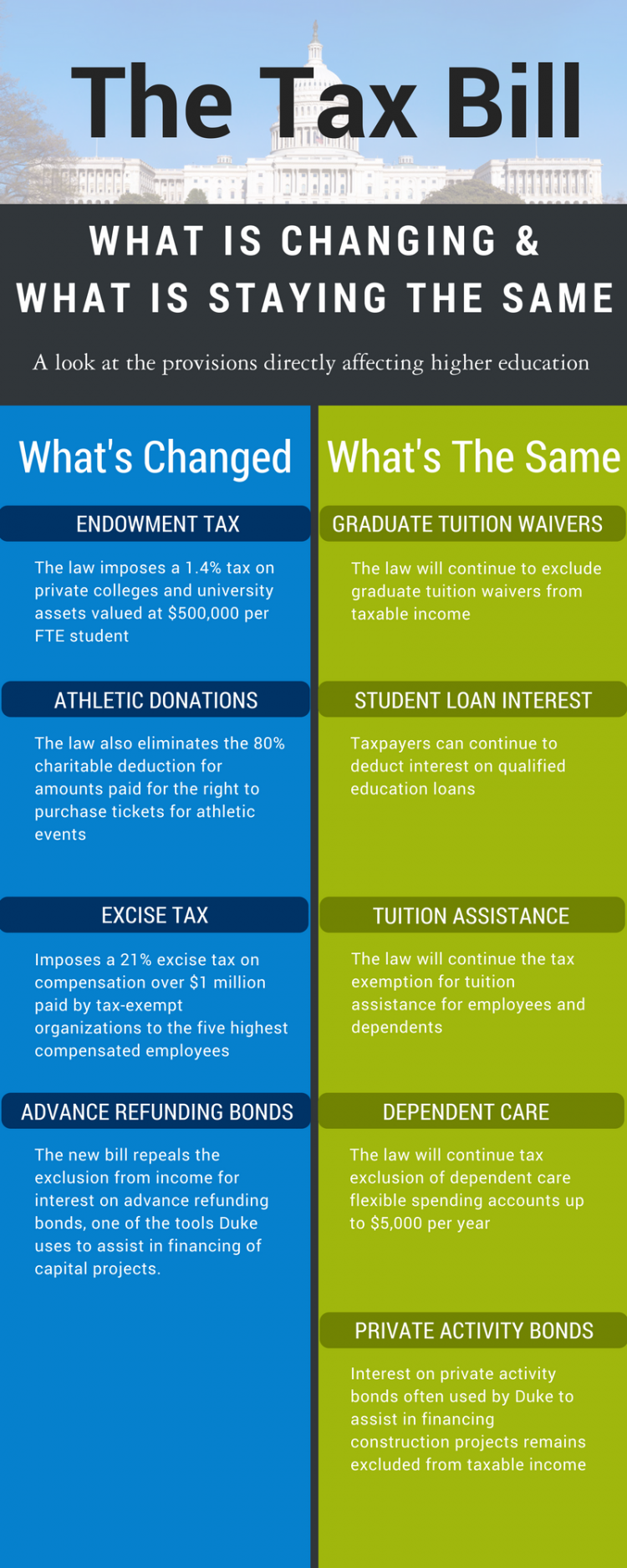

The existing student loan interest deduction allows borrowers to deduct a certain amount of student loan interest paid during the year from their taxable income. The new bill may propose expanding this deduction, increasing the maximum deductible amount, or removing income limitations that currently prevent some borrowers from claiming the deduction. A larger deduction directly translates to a lower tax liability for borrowers.*

Taxability of Loan Forgiveness:

Currently, under certain income-driven repayment (IDR) plans, the remaining student loan balance can be forgiven after a specified number of years of qualifying payments. However, this forgiven amount is often treated as taxable income by the IRS, potentially creating a significant tax burden for borrowers who were expecting debt relief. The new bill might address this issue by making student loan forgiveness tax-free, specifically for those participating in IDR plans or other qualifying forgiveness programs like Public Service Loan Forgiveness (PSLF).*

Employer-Sponsored Student Loan Assistance:

Some companies are beginning to offer student loan repayment assistance as an employee benefit. The new bill could incentivize this trend by expanding tax benefits for employers who contribute to their employees' student loan debt. This could make it easier for graduates to pay off student loans.*

Simplifying Repayment Plans:

One common complaint is the sheer complexity of the various repayment plan options. The new bill could mandate a simplification of the application process or consolidate existing plans to make it easier for borrowers to choose the right option for their financial situation.Potential Impact on Borrowers

The potential impact of this new student loan tax bill is considerable. Depending on the specific provisions enacted, it could:

*

Reduce the Tax Burden:

Expanding the student loan interest deduction or making loan forgiveness tax-free would directly reduce the tax burden for millions of borrowers, freeing up more funds for other essential expenses.*

Incentivize Repayment:

Tax benefits for employer-sponsored assistance programs could encourage more companies to offer this valuable benefit, helping employees pay down their debt faster.*

Increase Financial Stability:

By lowering monthly payments or reducing the overall amount owed, the bill could contribute to greater financial stability for borrowers, allowing them to save for retirement, purchase homes, and invest in their futures.*

Boost the Economy:

When borrowers have more disposable income, they are more likely to spend it, which can stimulate economic growth.Potential Challenges and Concerns

While the new student loan tax bill offers the promise of relief, it's also important to acknowledge potential challenges:

*

Cost to Taxpayers:

Making loan forgiveness tax-free or expanding deductions could increase the national debt. Lawmakers will need to carefully consider the financial implications of these proposals.*

Targeting of Benefits:

It's important to ensure that the benefits of the bill are targeted to those who need them most. For example, if the interest deduction is expanded without income limitations, it could disproportionately benefit high-income earners.*

Complexity of Implementation:

Any changes to the tax code can be complex to implement, and there is a risk that the new bill could create unintended consequences or require significant administrative resources.Staying Informed and Taking Action

It's crucial for borrowers to stay informed about the progress of this new student loan tax bill. Follow the news, contact your elected officials to voice your concerns, and consult with a financial advisor to understand how the bill might affect your individual circumstances. Understanding the potential benefits and drawbacks of this new legislation will empower you to make informed decisions about your student loan repayment strategy. The new Student Loan Tax Bill is more than just legislation; it's a potential game-changer for millions burdened by student debt.

Disclaimer:

*This article provides general information and should not be considered financial or legal advice. Consult with a qualified professional for personalized guidance.*

Comments

Post a Comment